A Guide to Wealth, for the Blue Collar Man

Blue-collar workers keep the world running, but too many never build real wealth. I started Hammer & Hustle to change that. You don’t need a degree or a Wall Street background. You just a plan and the drive to execute. This newsletter gives you real strategies to grow your money, start a business, and take control of your future.

Let’s build something bigger than a paycheck.

How to Buy Your First Rental Property While Working Full-Time

Let’s be real. You don’t need to quit your job or win the lottery to buy a rental property. You just need a plan, a little hustle, and the guts to make a move.

Here’s how you do it:

1. Stack Cash Quietly

Live below your means. Skip the flashy car. Save aggressively for your down payment—aim for 15–25% of the purchase price. This isn't about getting rich fast. It’s about buying freedom one brick at a time.

2. Get Pre-Approved

Before you even browse Zillow, talk to a lender. Know what you can afford, what your monthly mortgage would be, and how much cash reserves you’ll need. This also shows sellers you’re serious.

3. Choose a Simple, Working-Class Area

Your first rental doesn’t need to be fancy. Look for blue-collar neighborhoods with solid job markets and low vacancy rates. A 3-bed, 1-bath house near warehouses or hospitals can outperform a trendy condo downtown.

4. Run the Numbers Like a Business

Use the 1% Rule as a quick filter: If the monthly rent is at least 1% of the purchase price, it’s worth deeper analysis.

Example: Good Rental Property Math

Purchase price: $150,000

Down payment (20%): $30,000

Loan amount: $120,000

Interest rate: 7%

Monthly mortgage (P&I): ~$800

Property taxes + insurance: $200

Monthly rent: $1,600

Estimated repairs/maintenance (10% of rent): $160

Optional property management (8%): $128

Total monthly expenses:

$800 (mortgage) + $200 (taxes/insurance) + $160 (repairs) + $128 (management) = $1,288

Monthly cash flow:

$1,600 rent – $1,288 expenses = $312 profit/month

That’s $3,744 a year in cash flow, plus your tenant is paying down the mortgage and the house could appreciate. You’re building wealth on multiple fronts—all while working your day job.

5. Manage or Delegate

You can self-manage if you’re handy and local. But if you’re short on time or out of state, hire a property manager and build that cost into your model. The key is building a system that runs without you.

6. Start Small, Think Big

This first deal is your learning playground. It doesn’t have to be perfect. Just get in the game. You’ll learn more by owning one property than you ever will watching YouTube videos.

Remember: Wealth is built in boring, consistent moves. One property can turn into three. Three can turn into financial freedom.

Investment Term of the Day: Cash-on-Cash Return

Definition:

Cash-on-cash return measures the annual cash income earned on the actual cash you invested in a property. It’s one of the clearest ways to see how hard your money is working for you.

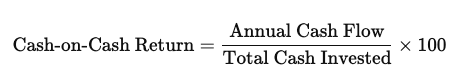

Formula:

Example:

You put $30,000 down on a rental property. After expenses, it nets $3,600 a year in cash flow.

That’s a 12% cash-on-cash return—not bad considering the bank pays you 1%.

Why it matters:

It tells you how much income your investment is generating relative to your out-of-pocket cash. It's a great gut-check for comparing different deals, especially in real estate.

-Hammer & Hustle Team